Your cart

Il n'y a plus d'articles dans votre panier

- Exclusivité web !

- -30%

Module Same price (products and shipping) after VAT applied pour PrestaShop

Version: 1.1.7 (2025-01-09) |

Compatibilité:

PrestaShop 1.5.0.0 - 8.2.x

|

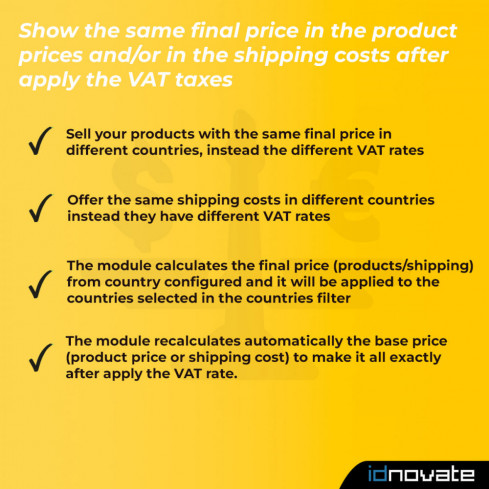

The module allows displaying same product prices and/or shipping costs despite the VAT rate applied. The base price is recalculated, so you can display the same final price (products and/or shipping costs) from specific country/zone price.

Always display the same price, even if there is a different VAT rate

No matter your customer's country. No matter if he's from Spain, France, Italy, or the United States. Doesn't matter the applicable VAT rate in each country.

The price of the product is calculated automatically

The price will not change depending on the customer's shipping address. The module recalculates the base price (price without taxes) automatically to match the VAT rate with the final price.

Examples:

Desired product price: €100

Customer from France - 20% VAT

Base price: €83.33 + 20% = €100

Customer from Spain - 21% VAT

Base price: €82.64 + 21% = €100

Customer from Italy - 22% VAT

Base price: €81.96 + 22% = €100

Customer from Germany - 19% VAT

Base price: €84.03 + 19% = €100

Customer from Sweden - 25% VAT

Base price: €80 + 25% = €100

You only need to set the final price: €100. The module calculates the base price automatically for each customer.

Now also applies to shipping costs

For shipping costs, the same criteria is applied but it’s taken into account if the carrier exists for the country that you want to apply the same final price, in case the carrier doesn’t exist for that country, the original price of the carrier will be applied.

Example:

Carrier X in France = €10

Carrier X in Spain = €14

Carrier X in Italy = €15

Carrier X in Sweden does not exist (doesn’t ship to Sweden)

Carrier Y ships to Sweden = €20 (doesn’t ship to France)

We activate in the module the option to apply the same final price to the shipping costs and the country configured to obtain the final price is France. The results would be:

Shipping costs to France = €10

Shipping costs to Spain = €10

Shipping costs to Italy = €10

Shipping costs to Sweden = €20 (unchanged because the French carrier doesn’t exist for Sweden).

Have a commercial price for all your countries

You can define a commercial price for your default country, but it gets ugly when you apply a different VAT rate.

For example, if you have a product price of €99.95 in France (20% VAT rate), it gets ugly when you display it in Spain (21% VAT rate): €100.78.

With this module it will be displayed the same price for all your countries, independently of the VAT rate applied: €99.95

Display the same price in all the purchasing process and improve abandonment cart rate

If your customer gets connected from a different country than the default country, or if he sets a different delivery address than the default country, a different VAT rate will be applied.

Probably he saw a product price different from the product price displayed in the checkout once logged.

It can cause him distrust, and he could abandon the cart.

For sure, he will not think that it's because of VAT rate, but probably a scam or bad practice.

With this module, the customer will see the same product price in all the purchasing process.

Example:

Your store is located in France and you are applying a 20% VAT rate.

When a customer from Spain visits your store, he will see products with 20% VAT rate.

When he logs in on the checkout, 21% VAT rate from Spain will be applied and products will be more expensive.

A single payment

The module has no additional costs. You only need to make one payment for the module licence for your store.

Multiple filters

You can set this behavior only for some products or some customers. The module has several filters where you can define to which products and to which customers apply it.

Example:

Only for products from category A and customers belonging to customers group B.

Multi-shop

You can use the module in all the stores on your multi-shop, and you can create a different configuration for each of these.

Responsive and cross browser

This module is adapted for all devices: PC, tablet and mobile. It is also compatible with all browsers.

Compatible with all the themes and all other modules in your store

You can use this module with any platform you are using and it will function with any other modules you have installed in your store. If you have any problems, we will resolve them for you.

Multi-language texts

All the texts on this module can be translated into the languages of the store.

New functions

If you need any new functions that we haven’t developed for this module yet, do not hesitate to contact us by sending a message through the “Contact the developer” option.

Always updated

We frequently add updates to the module, to incorporate new functions and to adapt it to the latest versions of PrestaShop.

We can help you with the installation and configuration

If you have any questions, or a problem emerges during installation and configuration of the module, send us a message through the “Contact the developer” option and we will help you.

- Version

- 1.1.7 (2025-01-09)

- Compatibilité

- 1.5.0.0 - 8.2.x

- Évaluation

- 5

- Notes

- 3

- Téléchargements

- 329

- Langues

- EN, AG, BR, CB, CS, DE, ES, FR, GB, IT, JA, MX, PL, PT, QC, RU, SK, TW, ZH

- Nécessite un service externe

- Non

Avis clients

Les clients qui ont acheté ce produit ont également acheté...